wv estate tax return

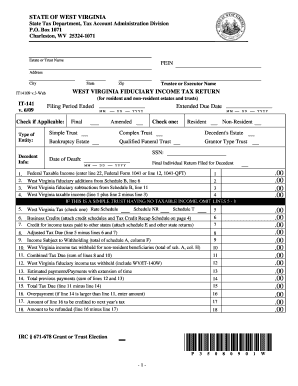

The proper forms and instructions will be sent to the fiduciary once the appraisement has been received by the State Tax Department. You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death.

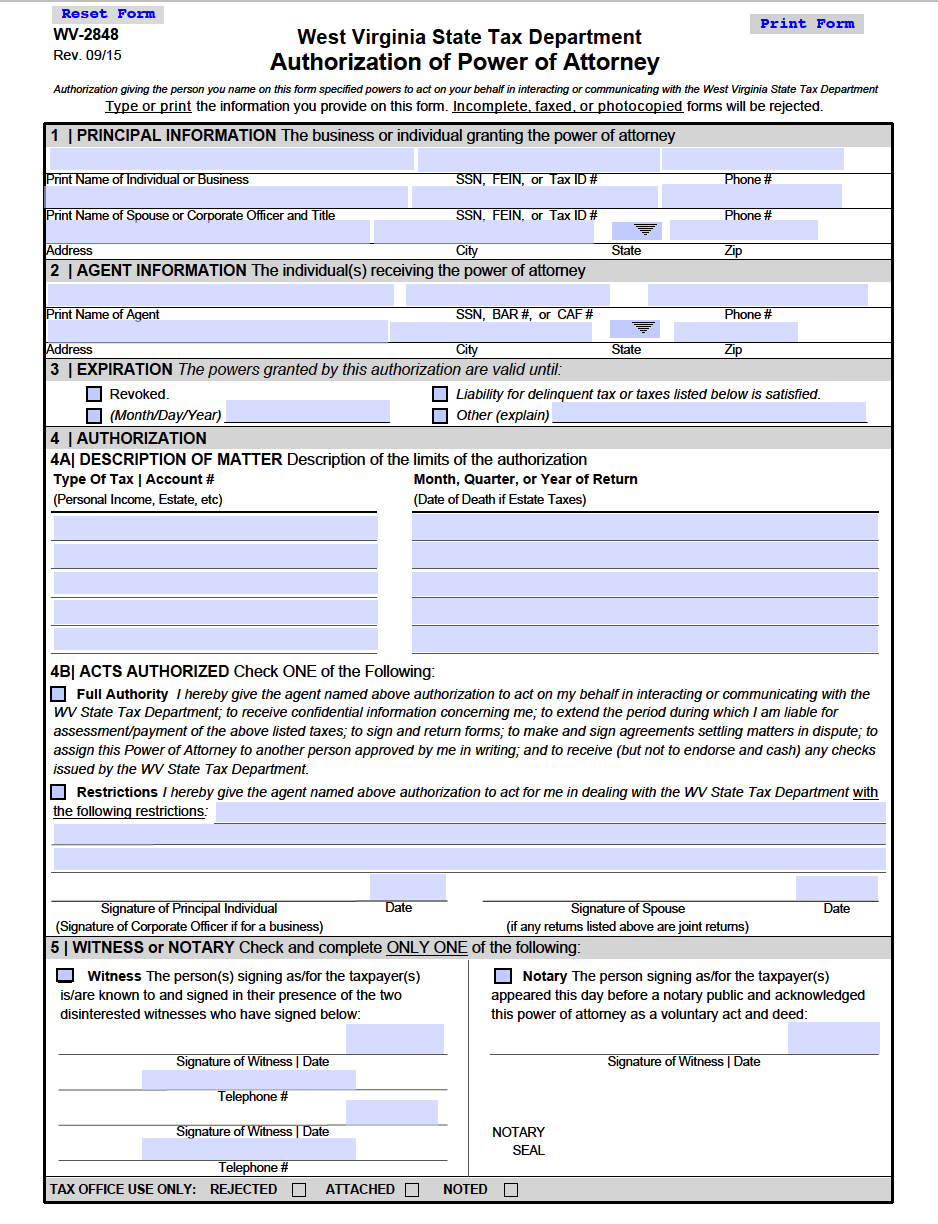

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

The gift tax return is due on april 15th following the year in which the gift is made.

. Find IRS or Federal Tax Return deadline details. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a WV state return. 13 rows West Virginia wont tax your estate but the federal government may if your estate has.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. The West Virginia tax filing and tax payment deadline is April 18 2022. Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return.

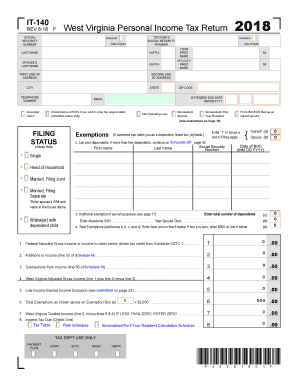

Download Complete Form IT-140 for the appropriate Tax Year below. This Form can be used to file a. Before filing form 1041 you will.

For other forms in the Form 706 series and for Forms 8892 and 8855 see the related. All estates get a 600 exemption. If you file in any month except December the estate has whats called a fiscal tax year instead of a calendar tax year.

However certain remainder interests are still subject to the inheritance tax. Check the status of your West Virginia state tax refund using these resources. No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article.

The gift tax return is due on April 15th following the year in which the gift is made. HttptaxwvgovPagesdefaultaspx Refund Status Phone Support. The taxable year of the estate or trust for West Virginia income tax purposes is the same as the one used for federal tax purposes.

In addition if you are inheriting property from another state that. You will be prompted to enter. The West Virginia Department of Tax and Revenue audits all Assessors each year.

Terms Used In West Virginia Code 11-11-8 Beneficiary. For tax year 2021 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 18 2022. WV Tax Amendment Form IT-140.

Only estates subject to the tax imposed by West Virginia Code 11-11-3 will be issued a release of lien pursuant to West Virginia Code 11-11-17. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. 31 rows Generally the estate tax return is due nine months after the date of death.

Wheres My West Virginia State Tax Refund. For anyone who has received or is anticipating an inheritance following is a short guide to West Virginia inheritance tax. Not to be confused with an estate tax which is payable from the estate of the deceased an inheritance tax is paid by a person who inherits from the deceased.

STATE OF WEST VIRGINIA This form to be used only for Est 76 Rev. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. Declaration of preparer other than personal representative is based on all information of which.

For decedents dying July 13 2001 and after a release or certificate of non-liability from the West Virginia State Tax Department. We have both the skills and expertise to ensure that estate and gift taxes are properly considered as part of your overall tax plan and that your tax returns are filed with. An inheritance tax is one method states use to tax the transfer of wealth.

1-800-982-8297 Email Tax Support. West Virginia collects neither an estate tax nor an inheritance tax. STATE TAX DEPARTMENT SPECIAL AUDITS ESTATE TAX UNIT POST OFFICE BOX 1923 CHARLESTON WV 25327 Under penalty of law I declare that I have examined this return and to the best of my knowledge and belief it is a true correct and complete return.

To check the status of your West Virginia state refund online go to httpsmytaxeswvtaxgovlinkrefund. A person who is entitled to receive the benefits or proceeds of a will trust insurance policy retirement plan annuity or other contract. Then click Search to find your refund.

Your taxpayer ID Social Security number of the first person shown on the return The tax year. The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as. Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Does West Virginia have an Inheritance Tax or an Estate Tax. If you dont have access to a computer you may call the West.

Check the Amended return box on Form IT-140. West Virginia State Income Taxes for Tax Year 2021 January 1 - Dec. TaxHelpWVGov 2020 State Tax Filing.

The West Virginia State Code directs all Assessors to value property at market value what the property will sell for on the open market with a willing buyer and seller and will allow for only a 10 variation from the market value. Tax Return will also be required to file a West Virginia Estate Tax Return. July 2002 ESTATE TAX RETURN estates of decedents who died after June 30 1985 Chapter 11 Article 11 Decedents Last Name Date of Death First Name Middle Initial Domicile at Time of Death Social Security Number Year Domicile Established Complete Mailing Address and SS Name of.

The proper forms and instructions will be sent to the ExecutorAdministrator after the appraisement has been filed. Wednesday December 8 2021. Tax Return Tax Amendment Change of Address.

Sign Mail Form IT-140 to the address listed above. The tax period must end on the last day of a month. You can also deduct.

West Virginia Estate Tax Everything You Need To Know Smartasset

Wv State Tax Department Fiduciary Estate Tax Return Forms Fill Out And Sign Printable Pdf Template Signnow

Wv Schedule M It 140 2020 Fill Out Tax Template Online Us Legal Forms

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

2012 2022 Form Wv Dor Nrsr Fill Online Printable Fillable Blank Pdffiller

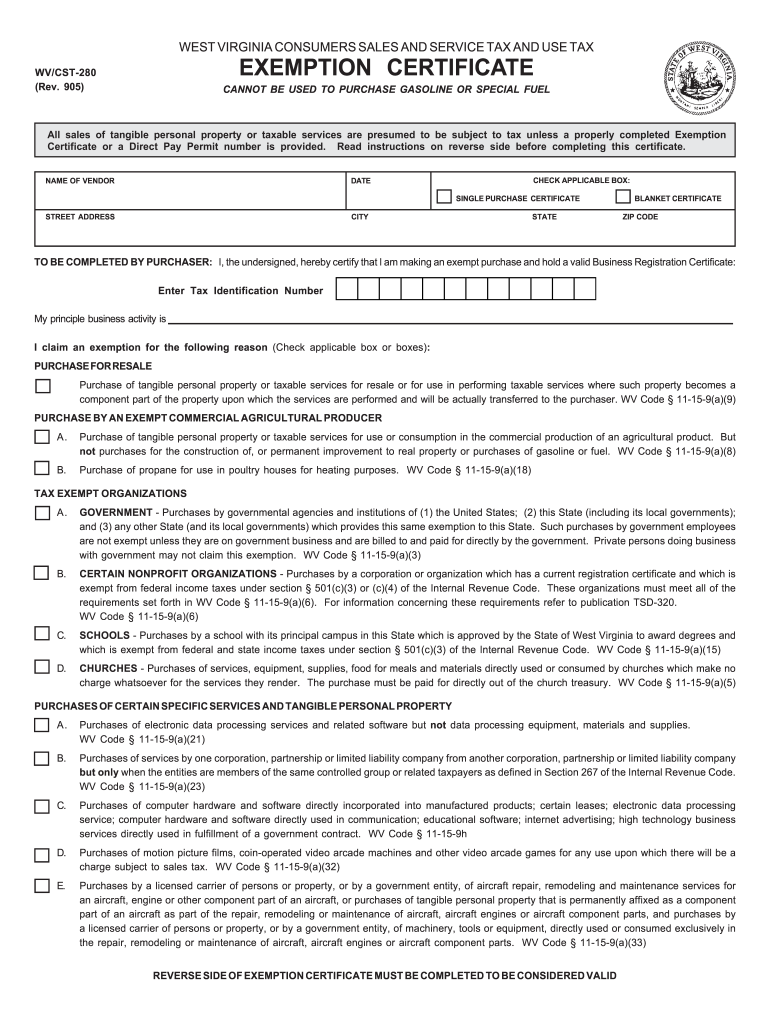

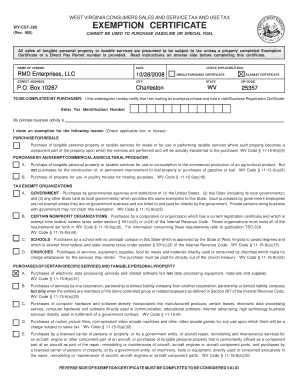

Wv Tax Exempt Form 2021 Fill Online Printable Fillable Blank Pdffiller

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms West Virginia Tax

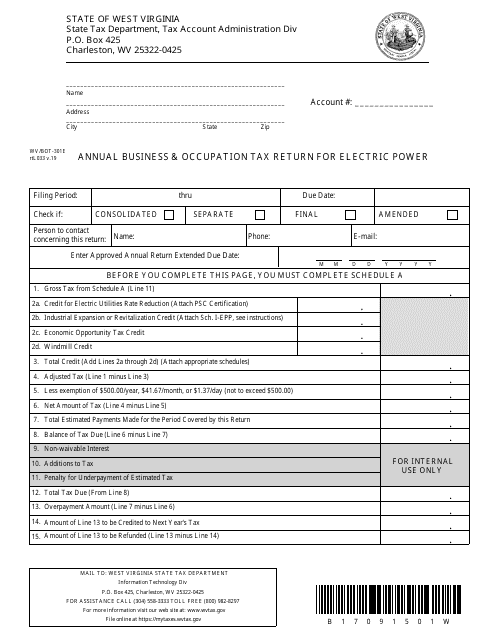

Form Wv Bot 301e Download Printable Pdf Or Fill Online Annual Business Occupation Tax Return For Electric Power West Virginia Templateroller

Form Wv Bot 301 Download Printable Pdf Or Fill Online Annual Business Occupation Tax Return For Utilities West Virginia Templateroller

Wv Cst 280 Fill Online Printable Fillable Blank Pdffiller

Free Form Cst 280 Consumers Sales And Service Tax And Use Tax Exemption Certificate Free Legal Forms Laws Com

Gap Between Homeowners Appraisers Narrows To Lowest Mark In 2 Years Real Estate Nj Real Estate Articles Real Estate Houses

West Virginia Estate Tax Everything You Need To Know Smartasset

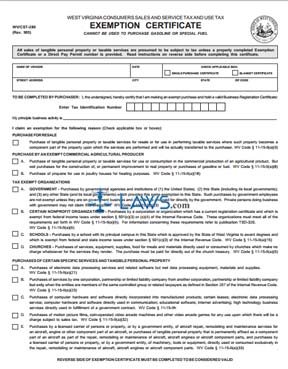

Form Wv It 103 Download Printable Pdf Or Fill Online West Virginia Withholding Year End Reconciliation West Virginia Templateroller

Wv Tax Deadline Extended To May 17 Wowk 13 News

Wv State Tax Forms Fill Out And Sign Printable Pdf Template Signnow

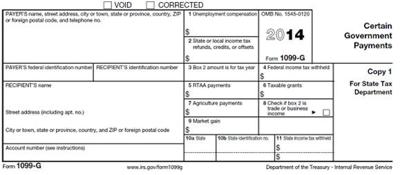

Wv Tax Department No Longer Sending 1099s Business Wvgazettemail Com