reverse sales tax calculator california

Here is how the total is calculated before sales tax. Current hst gst and pst.

Us Sales Tax Calculator Reverse Sales Dremployee

If you want to know how much an item costs without the Sales Tax you might want to.

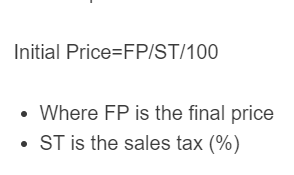

. California State Sales Tax. California State Sales Tax. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax.

Before tax price in case of Reverse. To calculate the total amount and sales taxes from a. Maximum Possible Sales Tax.

Ad Lookup Sales Tax Rates For Free. Often knowing the post-tax price in one municipality will provide little information of value to a person who is not subject to the same tax structures. For example if the.

Maximum Possible Sales Tax. If the rate is. Here is the Sales Tax amount calculation formula.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Formulas to Calculate Reverse Sales. Amount without sales tax GST.

Maximum Local Sales Tax. California has a 6 statewide sales tax rate but also. Average Local State Sales Tax.

This Sales Tax Calculator And De-Calculator will calculate sales tax from an amount and tax or reverse calculate with the tax paid. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. To 1200 midnight et 7 days a week for english and 9 am.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. This rate is made up of 600. Take the gross amount of any sum items you sell or buy that is the total including any VAT and divide it by 1175 if the VAT rate is 175 per cent.

How do you calculate tax. The statewide California sales tax rate is 725. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Sales Tax total value of sale x Sales Tax rate. Average Local State Sales Tax.

California sales tax calculator is as per the California sales tax percentage rate effective 1st January 2020. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. Maximum Local Sales Tax.

Interactive Tax Map Unlimited Use. To calculate the sales tax backward from the total divide the total amount you received for the items subject to sales tax by 1 the sales tax rate. You can calculate the reverse tax by dividing your tax receipt by 1 plus.

Home Top Free Apps. The Sales Tax Calculator over here finds out the Tax imposed on various goods and services easily and makes your calculations quick and simple.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Best Practices For Sales Tax Display In The Checkout

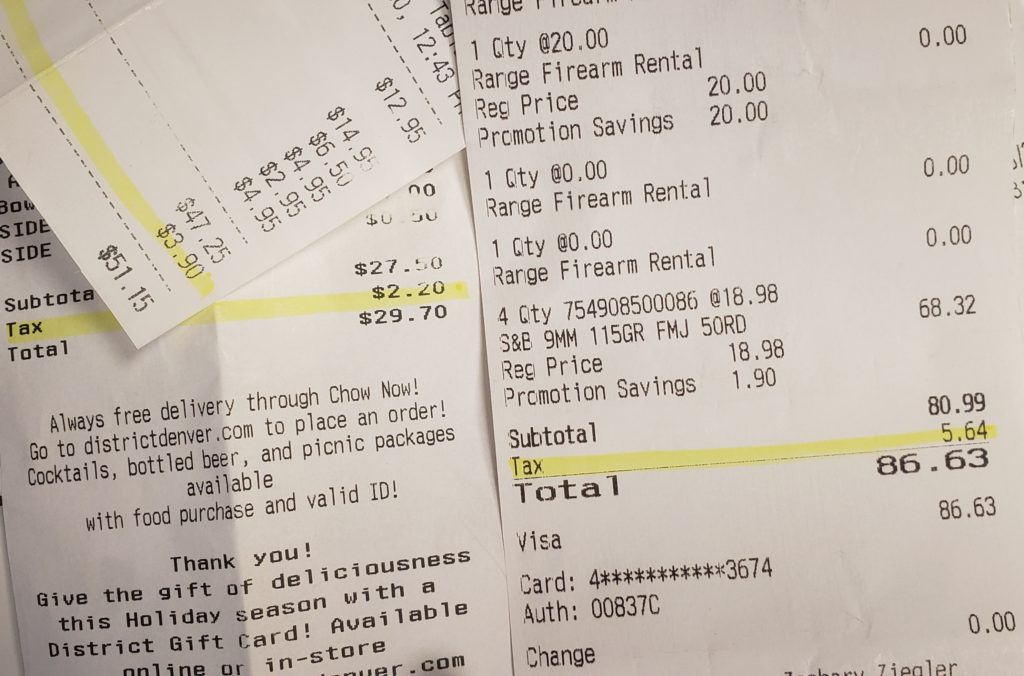

Denver Colorado Sales Taxes Increased Without Voter Consent Independence Institute

Tip Sales Tax Calculator Salecalc Com

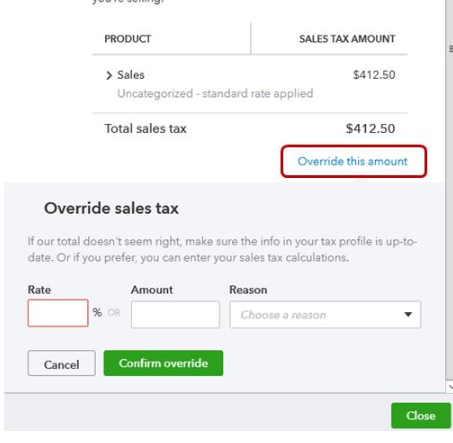

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator Calculator Academy

Reverse Sales Tax Calculator De Calculator Accounting Portal

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

California Sales Tax Calculator Reverse Sales Dremployee

Sacramento County Sales Tax Rates Calculator

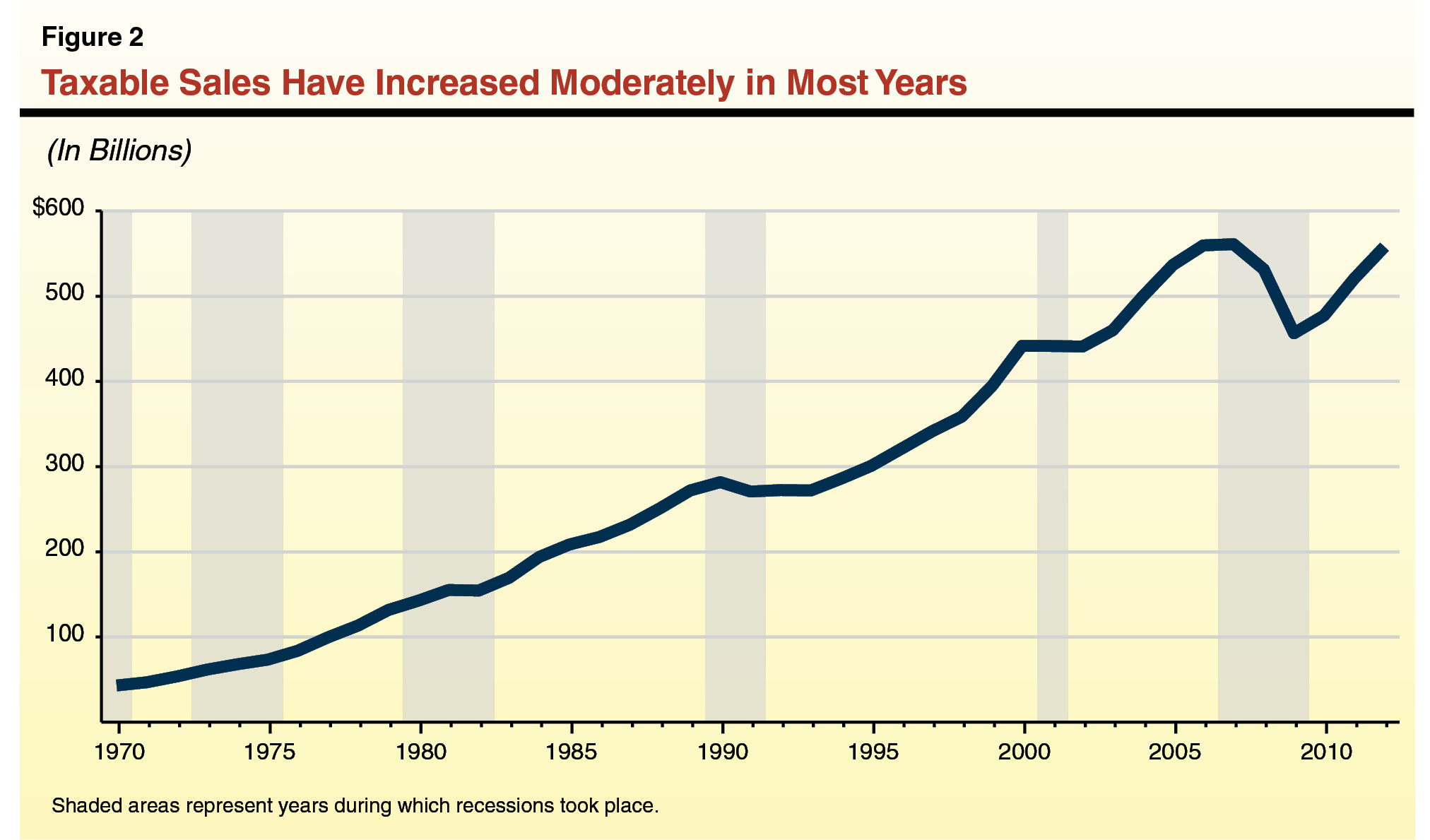

Why Have Sales Taxes Grown Slower Than The Economy